As one of Asia’s leading retail hubs, Hong Kong has long been a mecca for luxury shoppers. Despite being home to APAC’s most expensive retail real estate (second globally to New York City’s 5th Avenue), there’s a reason why large, sprawling luxury shopping malls continue to dominate in a crowded city.

Hong Kongers will be glad to know, though, that it holds its own when it comes to homegrown luxury spending, which recently overtook foreign consumption at 55% of total purchases.

This figure is staggering when considering the total population of Hong Kong is roughly 7.3 million people, less than a quarter of the 60 million visitors it hosts each year.

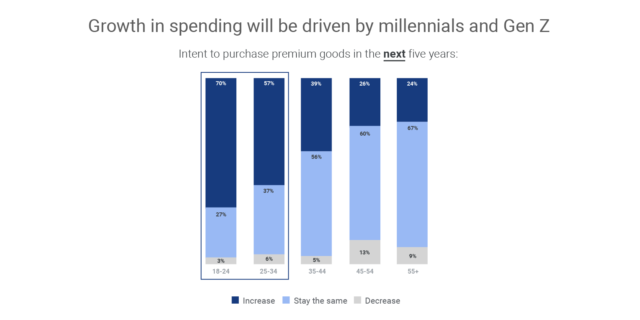

For these locally based consumers, luxury isn’t a one-off, aspirational purchase — it’s an innate part of their lifestyle, which explains why 93% of shoppers intend to maintain or increase spending in luxury goods in the next five years.

This holds true especially for the younger millennial shoppers who will be driving the majority of the growth going forward.

The evolving nature of consumers is a common challenge for many marketers, and the luxury industry is no exception.

The task at hand for brands in Hong Kong is to understand this distinct group of younger customers and the behaviors that shape their expectations when it comes making high-value purchases.

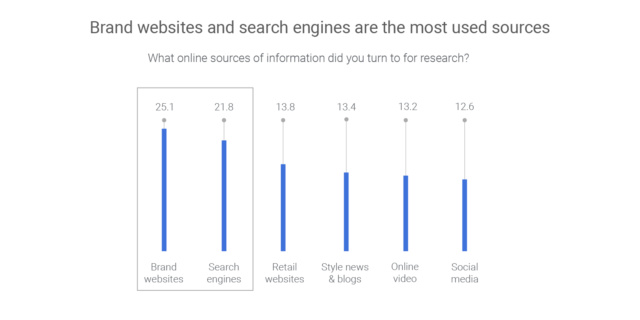

Reportedly, 90% of luxury shoppers conduct research online before making a purchase, and brand websites and search engines are the two most popular sources people turn to. In fact, they’ve become the digital storefront for this generation of digital natives.

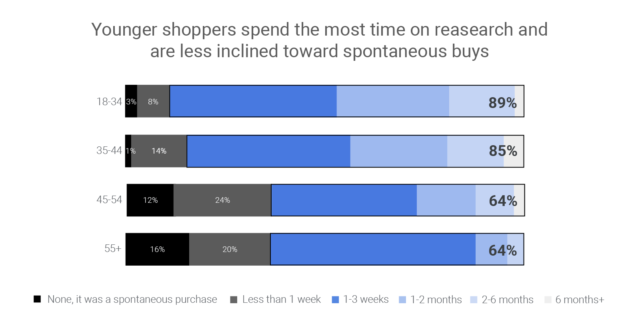

Having grown up with readily available information online, millennial and Gen Z consumers spend more time on research than ever before.

In fact, 89% of shoppers aged 18-34 spend up to three weeks researching a luxury purchase. And they’re not alone: 64% of consumers over 45 will spend the same amount of time on research leading up to a purchase.

Retailers may have once treated online as a separate channel to physical stores, but this notion is quickly becoming outdated.

Whether customers are online or offline is a distinction made by businesses, not consumers.

Online and offline consumer behaviors are increasingly blurring, and the respective experiences need to follow suit, particularly when it comes to the inspiration and research phases.

In short, consistency across the two worlds is key.

It’s hard to imagine a luxury label leaving a customer linger unattended to in its boutique, so, by the same token, a customer should never be left unanswered or ignored on Google, YouTube, or social.

With a more exploratory consumer mindset, brand loyalty may be more elusive for brands targeting younger shoppers.

Engaging potential millennial and Gen Z luxury shoppers constantly by trying to stay top of mind and being always on will be crucial to gaining consideration.

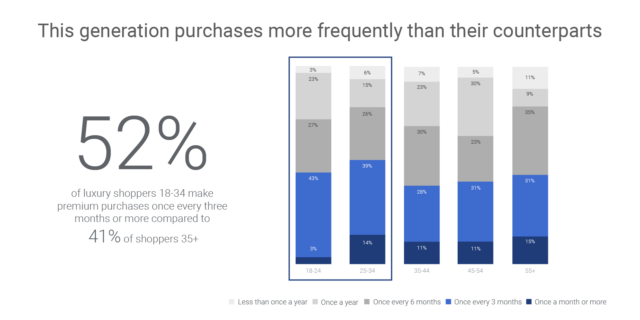

In today’s environment of fast fashion and overnight style sensations — while couture brands used to produce two collections per year, they now produce five to six — one of every three consumers surveyed said they make luxury purchases to keep up with trends.

The tendency to shop more often is evidenced among shoppers aged 18-34, of whom 52% reported making premium purchases once every three months, compared to just 41% of shoppers 35+ who did the same.

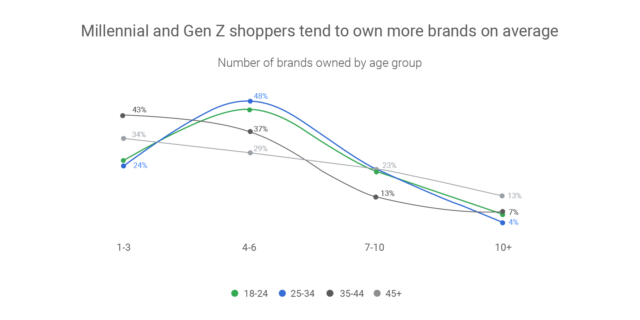

In addition to a higher frequency of purchase, our research also shows that millennial and Gen Z shoppers are likely to consider a wider breadth of brands. On average, this group owned products from a repertoire of four to six brands; compared to more brand-loyal 35+ shoppers, who owned between one and three brands.

When it comes to in-store shopping, the aspects that customers value most are: 1) guaranteed authenticity, 2) the ability to touch and feel the product, and 3) personalized customer service.

How might these values translate online? With 63% of people expecting the same high-touch brand experience online and offline, the challenge is to emulate these qualities and provide satisfying digital experiences.

Offering free shipping on returns, for example, gives peace of mind to customers wary of counterfeit goods. Similarly, detailed product videos on the brand site or as a pillar of content on YouTube can help shoppers inspect items for quality while engaging them in a rich experience.

Leveraging customer data, such as previous purchases, to create individualized interactions and recommendations is no longer a nice-to-have, but a must. Just as consumers expect personalized customer service in store, personalization is fundamental for designing a top-notch digital brand experience.

Millennial and Gen Z consumers spend the most time on research, so it pays to provide as much information as possible to this group. They also purchase more frequently, and they consider more brands when they do so.

To stay top of mind, brands should ensure that they are present at as many touch points as possible and that their media strategies are always on.

Expectations for online shopping are growing higher by the day, and this is especially true for premium brands.