Thai co-working space Hubba has raised a pre-series A funding round, it announced yesterday. The company got US$350,000 in a round led by US-based venture capital firm 500 Startups. The round was joined by 500 Startups’ Southeast Asian fund 500 Durians and Thai fund 500 Tuk Tuks.

Singapore-based VC Golden Gate Ventures and Thailand-based VC Ardent Capital also participated. Several local angel investors got involved as well, including Computerlogy CEO Vachara Aemavat, Playlab CEO Jakob Lykkegaard Pedersen, and Stock2morrow CEO Piyaphan Wongyara.

Under the deal, Ruangroj “Krating” Poonpol, venture partner at 500 Tuk Tuks, will join Hubba’s board of directors.

Hubba’s investors will be working with startups that use the company’s spaces to help mentor them, and even to potentially invest in some of them, Amarit says. The company will also work together with its investors on joint programs and activities going forward.

Hubba was the first co-working space in Thailand, founded by brothers Amarit and Charle Charoenphan in 2012. Today the company has a presence in seven locations and holds minority stakes in other co-working spaces like Punspace in Chiang Mai, Thailand, and Toh Lao in Vientiane, Laos.

In the last three years, it has worked to build up the country’s startup ecosystem through its co-working space business as well as community activities and events. Last year, it also launched Pah Creative Space, a co-working space for designers and other creative freelancers.

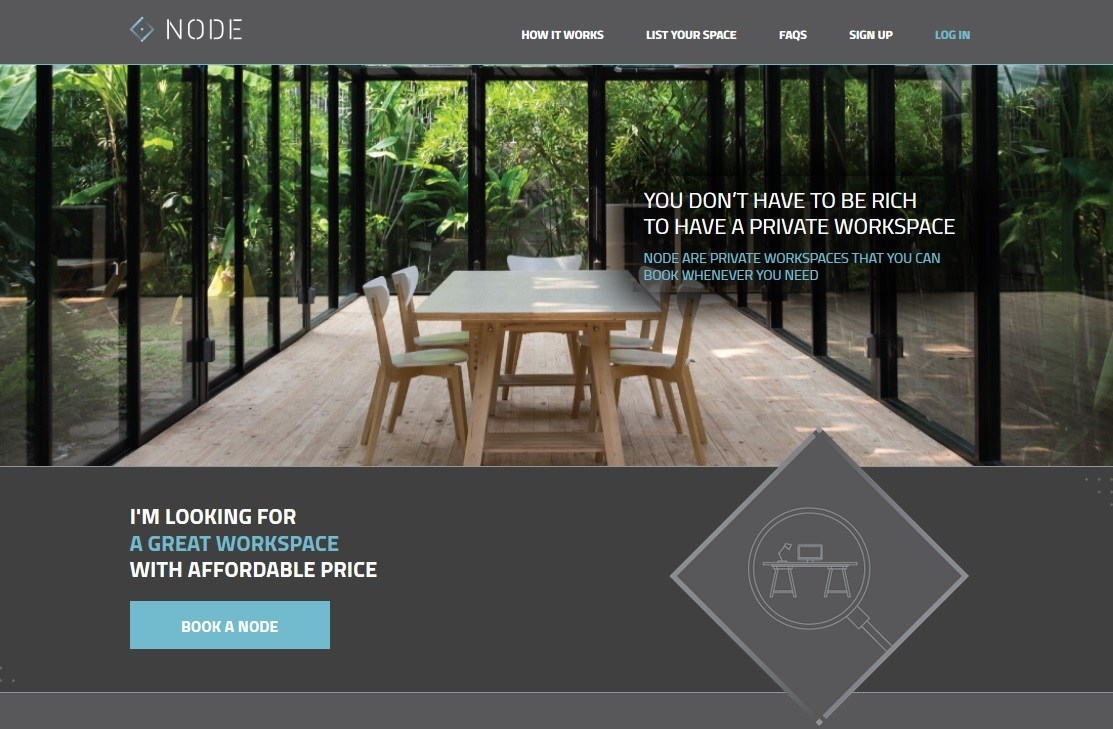

Hubba will use the new funding to fuel two new projects, Amarit says. One of them is Hubba-to, a planned artisan co-creation community that the company plans to launch in partnership with Thai real-estate developer Sansiri. The other is Node, a prototype for an “automated office” that will “enhance efficiency and reduce unnecessary expense.”

“It’s going to work like Airbnb for private rooms and office spaces,” Amarit says. Node offers spaces that can be rented out for specific time slots and used for offices, meeting rooms, and so on. Landlords can list their properties on the site and wait for bookings to come. Payment via credit card is handled by the site. The listings include WiFi and amenities such as pens and notepads, and are cleaned by Node staff after use.

“Our killer feature is that we will have what is called Node Plus,” Amarit explains. “[Those] are spaces that have been fully equipped with IoT (internet of things) and technology that allows spaces to be fully booked on-demand and managed remotely with no need for staff (locks, lights, AC, WiFi, and security).”

The automation will help keep operating costs and booking fees down, Amarit says. Node takes a 20 to 30 percent commission from property owners.

Taking the Airbnb approach to professional spaces is an interesting twist on the model used by Wework, the US-based co-working space decacorn, which sub-leases existing office space to entrepreneurs and freelancers.

“I think everyone in the co-working world is amazed and in awe of Wework and its lofty projections,” Amarit says. “However, I think the markets we work in are definitely different from Wework, so we can’t just clone it. We need to find our own Southeast Asian model and Hubba-to and Node may be the way forward.”

Hubba expects the funding to give it enough time to pursue “multiple growth trajectories.”

“We will look to raise again in 2016 as we build traction and momentum for both projects,” he says.