The launch this coming June of Shanghai Disney Resort, which will be one of the largest theme parks in mainland China, is the first upbeat topic in a long time for the country which has been swayed by economic slowdown and the stock market plunge.

Meanwhile, Hong Kong Disneyland — some 1,200km southwest of Shanghai and which celebrated its 10th anniversary last year — is concerned that the new Disneyland in mainland China could result in a decline in visitors in its home turf.

Walt Disney of the U.S. and Shanghai Shendi Group of China, which are jointly building Shanghai Disney Resort, said Jan. 13 that the first phase of the theme park will open on June 16. The announcement boosted shares in Shanghai Jinjiang International Hotels Development, the operator of nearby hotels, and real estate developer Shanghai Jinqiao Export Processing Zone Development. These companies are expected to benefit greatly from the launch of the theme park. The stock price of Shanghai-based China Eastern Airlines, which partners with Shanghai Disney Resort, also soared on the Hong Kong stock market.

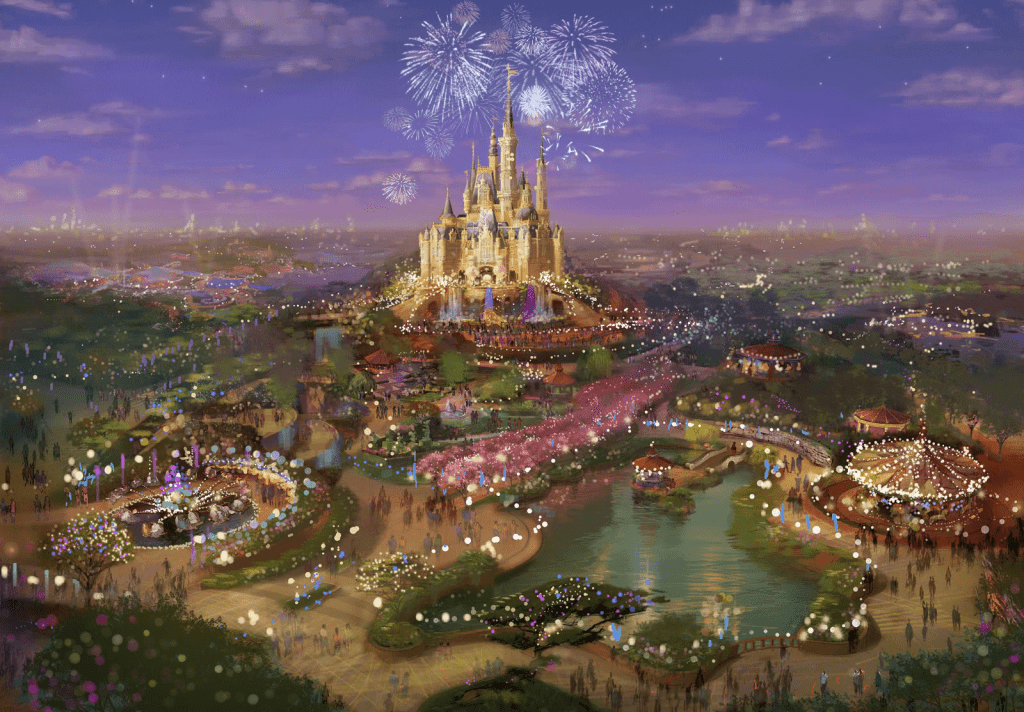

Nearly 10 years from the plan, five years from the start of construction and two years behind the original plan, the dream of the Shanghai economic community will finally come true. Shanghai Disney Resort — which will be the sixth in the world and the third in Asia after Tokyo and Hong Kong — will be equipped with hotels and commercial complexes, with the construction cost totaling $5.5 billion.

Structural shift

Stock market players predict the theme park will see more than 12 million visitors in its first fiscal year, easily surpassing Hong Kong Disneyland’s 7.5 million in 2014. The numbers are expected to jump to 40 million a year once the third phase of the park is complete. The numbers could top the 31.3 million visitors to Tokyo Disneyland and Tokyo DisneySea in 2014.

Major Chinese brokerage Haitong Securities expects Shanghai Disney Resort will “boost the city of Shanghai’s annual retail sales by 4%,” on the assumption of 15.6 million visitors and the daily average spending of 700 yuan ($106) per visitor in the first fiscal year. The theme park will also been seen as a test of whether China can shift from a manufacturing- and infrastructure-based economy to a service-driven economy.

Meanwhile, the Hong Kong stock market was once buoyed by the Disney boom. During the period from the end of October 2004 to the opening of Hong Kong Disneyland on Sept. 12, 2005, the stock prices of luxury hotel operator Shangri-La Asia and jewelry store operator Chow Sang Sang Holdings International surged 37% and 48%, respectively, on expectation that the opening of Hong Kong Disneyland would help boost tourist numbers. The share price of Macau casino operator Galaxy Entertainment Group also jumped 120%, and the benchmark Hang Seng Index rose 16%.

However, the share prices of retail and leisure companies in Hong Kong have remained sluggish, as the number of mainland visitors to Hong Kong has declined due to the Chinese government’s anti-corruption campaign and growing anti-China sentiment in Hong Kong.

In a survey of mainland Chinese members conducted by U.S. travel information website operator Travelzoo on their most preferred travel destination in 2016, Hong Kong was ranked 32nd, down from 23rd place, losing out to the 31st-ranked Africa.

Mainland-dependent

In addition to such unfavorable trend, officials of Hong Kong Disneyland are concerned they may have to compete with their Shanghai counterpart for customers.

Hong Kong Disneyland posted its first profit in fiscal 2012, hit by the 2008 global financial crisis and the 2009 swine flu pandemic. Its revenue base is not stable and is becoming more dependent on mainland visitors. The total number of visitors was up more than 60% to 7.5 million in 2014, from 4.6 million in 2009. The number of mainland visitors surged more than 120% during the same period, with their ratio to total visitors up from 36% to 48%.

Comparing the share prices of Shanghai Disney Resort-related companies and retail and leisure companies in Hong Kong with the end of 2012, when the construction of Shanghai Disney Resort began full swing, property developer Shanghai Jinqiao Export Processing Zone Development and Shanghai International Airport, the operator of the two international airports in Shanghai, saw their stock prices jump 70% and 110%, respectively. On the other hand, the stock prices of Shangri-La Asia and cosmetics retailer Sa Sa International Holdings in Hong Kong fell about 60% to 70%.

A spokesman for Hong Kong Disneyland stressed to Nikkei Quick News that the company is proud to be one of the top tourist attractions in Hong Kong over the last decade, and they strive to provide customers from around the world with a whole new experience. All eyes are on whether the two Disneylands in Hong Kong and Shanghai can coexist and prosper.