More than 1 in 4 food retailers in some of Asia’s fastest-growing economies expect to grow by 10 percent or more this year, according to research commissioned by DHL Supply Chain, the global market leader for contract logistics solutions.

Based on interviews with more than 300 industry decision-makers in India, Indonesia, Thailand and Vietnam, Hungry for Growth: Logistics Trends in Asia’s High-Growth Food Retail Markets also found that the majority of food retailers – more than 6 in 10 – predict significant growth of 6 percent or more this year as a result of expanding populations and rising income levels.

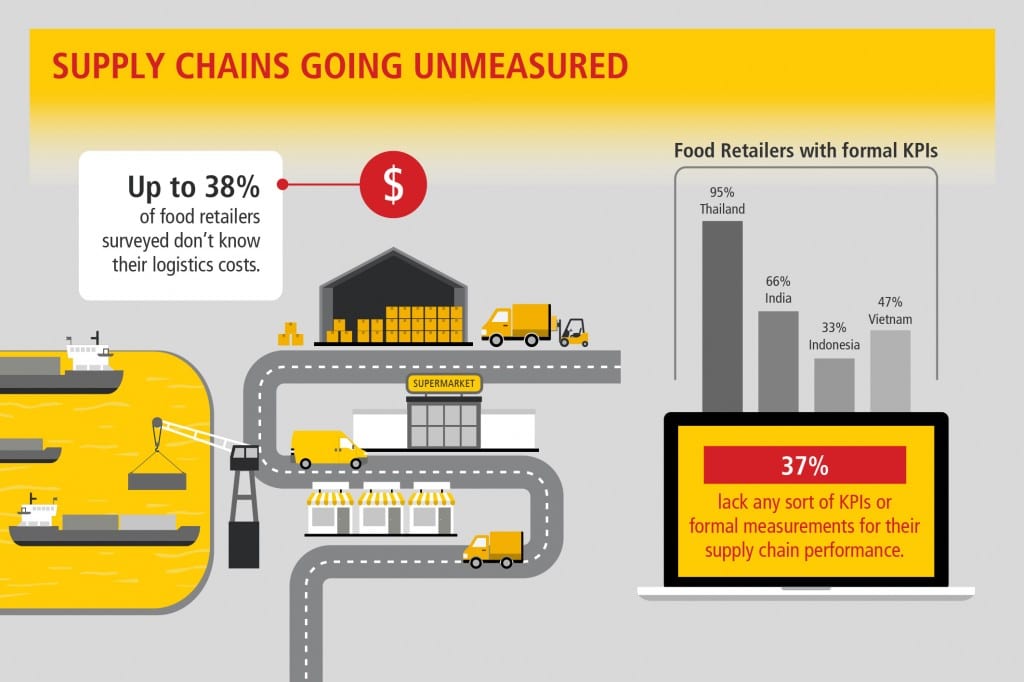

However, the report also found that up to 38 percent of those surveyed were unaware of their total logistics costs, while 37 percent lacked any KPIs or formal measurements for their supply chain performance – potentially impacting their ability to keep shelves stocked and orders filled as demand and competitive factors grow increasingly complex.

“Rapid increases in purchasing power, coupled with surges in demand driven by population growth, will yield obvious expansionary benefits to food retailers,” said Dean Eichorn, Vice President – Retail, DHL Supply Chain Asia Pacific. “However, any food retailer’s success is ultimately dependent on the agility of their supply chains when faced with demand volatility, seasonal fluctuations, and other complex market factors. Asia’s food retail industry looks set to undergo significant growth in the next year, and only with greater understanding and control of their logistics operations will companies be able to take advantage of new opportunities.”

The research found that food retailers are increasingly at risk from unpredictability on both demand and supply sides of their operations. In the four countries surveyed, late supplier deliveries were most commonly cited as food retailers’ top concern, while 36 percent admitted that demand volatility had a major impact on their businesses. Issues around supply chain performance and costs varied around the region: fuel, labor, and imbalances between supply and demand ranked amongst retailers’ top cost issues.

“Many of these concerns are amplified because a large number of food retailers don’t have visibility of their logistics operations, let alone the resources or subject expertise to improve and optimize them,” said Eichorn. “Food retailers need reliable, agile supply lines if they’re to focus on their core competencies and compete. At DHL, we believe this agility only comes from being able to manage the supply chain as an end-to-end process across transport, warehousing, and value-added services in a way that’s rapidly scalable without creating extra complexity.”

The research also found that more than 60 percent of food retailers have not outsourced any aspects of their supply chains, suggesting that retailers who actively adopt third-party logistics solutions stand to gain significant “first-mover advantages” against their competition. Of those surveyed, 44 percent believe inventory optimization technologies would be beneficial to their overall performance, while 38 percent see advanced transport management services, like “track and trace”, as helping them improve reliability in meeting demand.

“Asia’s food retailers recognize the need to innovate and change, but the technologies and process transformations required to do so aren’t their domain of expertise – and nor should they be,” said Eichorn. “The key to growth and expansion in Asia’s food retail industry, and those of other developing regions where we’re seeing similar trends, will be how effectively operators can take advantage of third-party expertise and managed solutions in everything from technology to end-to-end supply chain management. For food retailers looking to leapfrog their competition and stay on top of growth’s complexity, the time to embrace advanced supply management principles is now.”

About the Research:

Commissioned by DHL Supply Chain and conducted by Redshift Research, the Hungry for Growth report draws on responses collected between December 2014 and April 2015 from more than 300 food retail professionals in India, Indonesia, Thailand and Vietnam. The report defines “food retail” as referring to retailers who sell food to consumers primarily for off-premise consumption, including (but not limited to): grocery stores, convenience stores, hypermarkets, supermarkets, and specialist stores like butcheries and bakeries.

The full report can be downloaded from https://www.dhl.com/hungryforgrowth.