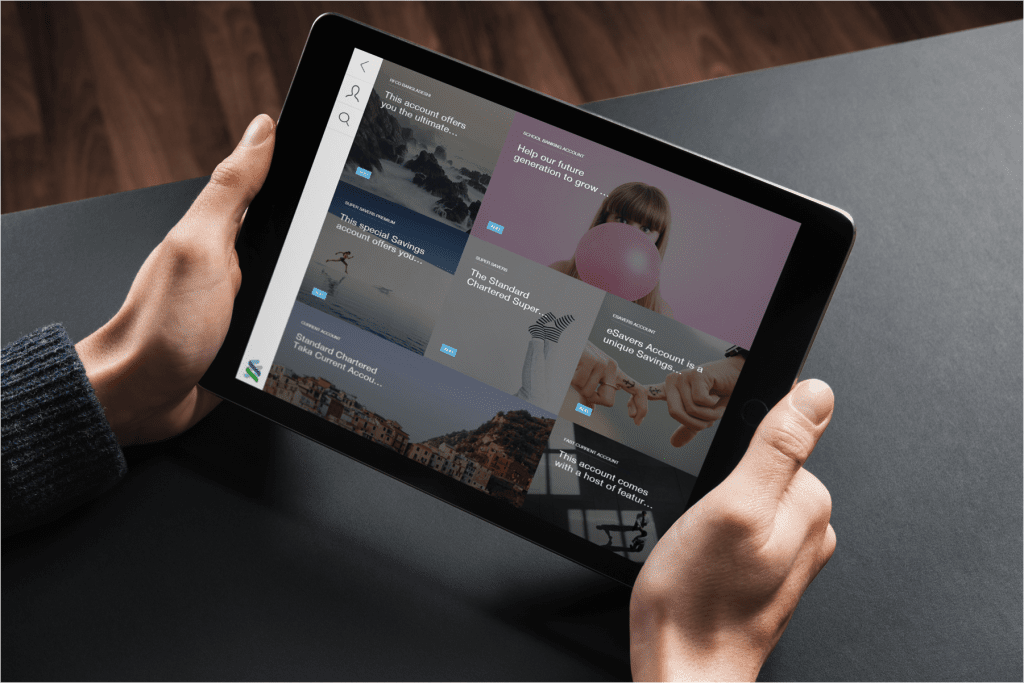

Malaysia is one of the first six markets to go live with Retail Workbench, a digital tablet-based sales-and-service tool, according to Standard Chartered Bank, which globally launch of its Retail Workbench,

The iPad tool is also live in India, the UAE, Bangladesh, Nigeria and Kenya, said Aaron Loo, country head, Retail Banking, Standard Chartered Bank Malaysia.

“Banking should be easy and convenient – that’s what the Retail Workbench is all about,” said Loo, adding that the application is integrated with the Bank’s back-end infrastructure, which will allow sales staff to open an account for a client in any location. Banking services such as loan approvals and credit card issuance will be fast, simple and completely paperless.

“We are harnessing technology to make banking a seamless experience for both clients and staff. Going paperless fits into the increasingly mobile lifestyle of our clients while improving cost efficiency and productivity by freeing up staff’s time to focus on what really matters, which is serving the client,” he said.

In addition, Loo said the ‘the bank on an iPad: Retail Workbench’ also puts a set of current and savings account, credit card and personal loan products on one mobile platform – along with product information and marketing brochures – so sales staff can answer questions and respond to client needs in person, at any location.

He said that with this fully digital device, we can process client requests from anywhere, with the data moving straight through to the Bank’s back-end operations in near real-time. Previously, sales staff could visit clients in person but the paperwork had to be manually entered into the Bank’s systems back at the branch or Bank’s premises.

Photo – Aaron Loo, Country Head, Retail Banking, Standard Chartered Bank Malaysia

This means that clients only need to give their personal data to the bank once to create a profile that can be used for future purchases. Sales staff use the iPad’s built-in camera to securely snap a picture of identity documents so there is no need to fill out multiple forms and no missing data.

Loo said Retail Workbench has already revolutionised the banking industry in Korea when it was launched in 2014, cutting account opening time in the digitally advanced country to five minutes and credit card issuance to less than half an hour. It has since won numerous industry awards for innovation and outstanding client service.

Due to differences in local infrastructure, turnaround times and other features of Retail Workbench will vary across the seven markets following the global launch, he added.

A statement added that Standard Chartered will successively add capabilities and enhance performance in each market over the coming months and equip more sales teams with the device. By the end of 2017, Retail Workbench will be in the hands of staff in 18 markets across Asia, Africa and the Middle East.

Digitising banking

The statement added that this global launch marked “a milestone in Standard Chartered’s strategy of using digital technology to deliver a better banking experience to clients. The Bank last year announced it will invest US$1.5bn in technology over three years. Standard Chartered was named the World’s Best Consumer Digital Bank in 2015 by Global Finance magazine and also won Best Consumer Digital Bank in Malaysia in 2010, 2014 and 2015.”

Standard Chartered Bank, a member of the Standard Chartered Group was established in Malaysia in 1875 and incorporated as Standard Chartered Bank Malaysia Berhad in 1984. Standard Chartered employs close to 7,000 employees in all its Malaysian operations.