The move by China-based tech firms into Southeast Asia continues apace. But the ranks of Alibaba and Tencent, so far the most aggressive to expand into the region, are now being joined by Alibaba’s largest ecommerce rival in China, JD.com.

Over the weekend, JD.com confirmed that it had invested in Indonesia-based ride-hailing service Go-Jek after news outlet The Information reported the development last week. According to Reuters, JD.com’s investment in the firm is around $100 million, and will be part of a funding round of about $1 billion.

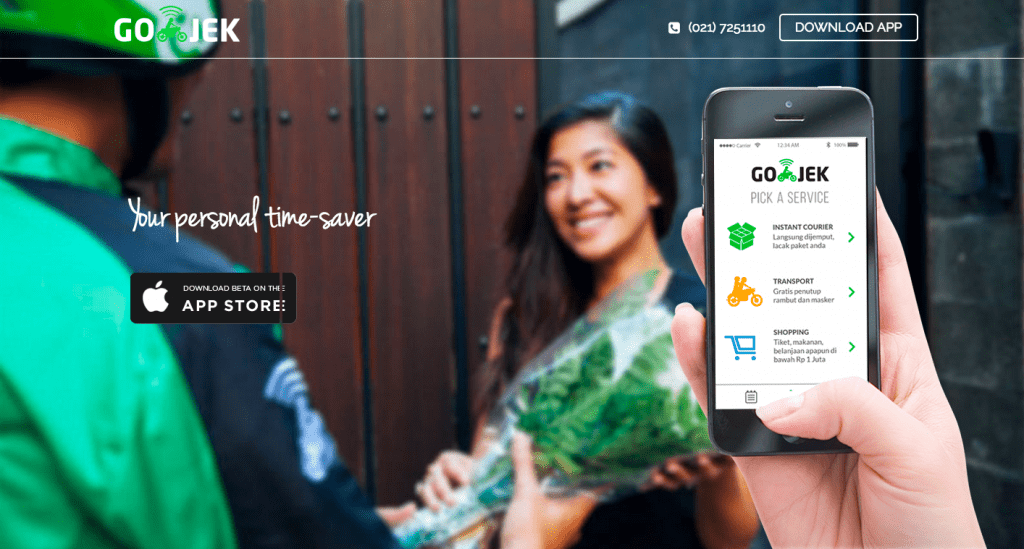

Go-Jek got its start in 2010 as an on-demand transportation platform for motorbikes, a common way for urbanites in Indonesia to navigate streets choked with traffic. However, Go-Jek’s portfolio of services has been broadly expanded since then to include grocery delivery, courier services, home cleaning, massages and even online ticketing.

Go-Jek appears to be mimicking the success messaging platform WeChat has seen in China, by gaining a user base for one service—online ride-hailing—and then branching out. Go-Jek is also smartly pushing its users to pay for its expanding suite of services using its own digital payment service, Go-Pay.

JD.com was once largely overshadowed by China’s ecommerce giant, Alibaba. But that has changed as the company’s model of using a business-to-consumer (B2C) ecommerce model—a contrast to Alibaba’s popular consumer-to-consumer (C2C) marketplace Taobao—has found success among a growing middle class in China that’s moving upmarket in the quality of goods it wants to purchase.

According to data from iResearch Consulting Group, JD.com was responsible for 24.7% of retail ecommerce sales share in China in 2016, behind only Alibaba’s B2C platform Tmall.

But JD.com is also clearly eyeing the potential in emerging markets like Indonesia. eMarketer estimates there will be 36.2 million digital buyers in the country this year, when retail ecommerce sales will total $8.21 billion. However, the ranks of buyers will swell to nearly 74 million by 2021, when $18.07 billion will be spent on retail ecommerce.

JD.com is set on making sure it doesn’t get left behind in the market through its Go-Jek investment. In return, Go-Jek is likely to gain from JD.com’s expertise in managing the nuts and bolts of the ecommerce business, including shipping logistics and inventory management, should it decide to expand its efforts in that sector.

Meanwhile, Go-Jek is given some more cash to fend off rivals Uber and Grab, a similarly Southeast Asia-focused ride-hailing app based in Singapore. Go-Jek can use all the money it can get its hands on; Grab, which operates in 65 cities in seven markets across Southeast Asia, closed a funding round worth $2.5 billion in late July from investors that include Japan-based telecom SoftBank Group and China-based ride-hailing giant Didi Chuxing.