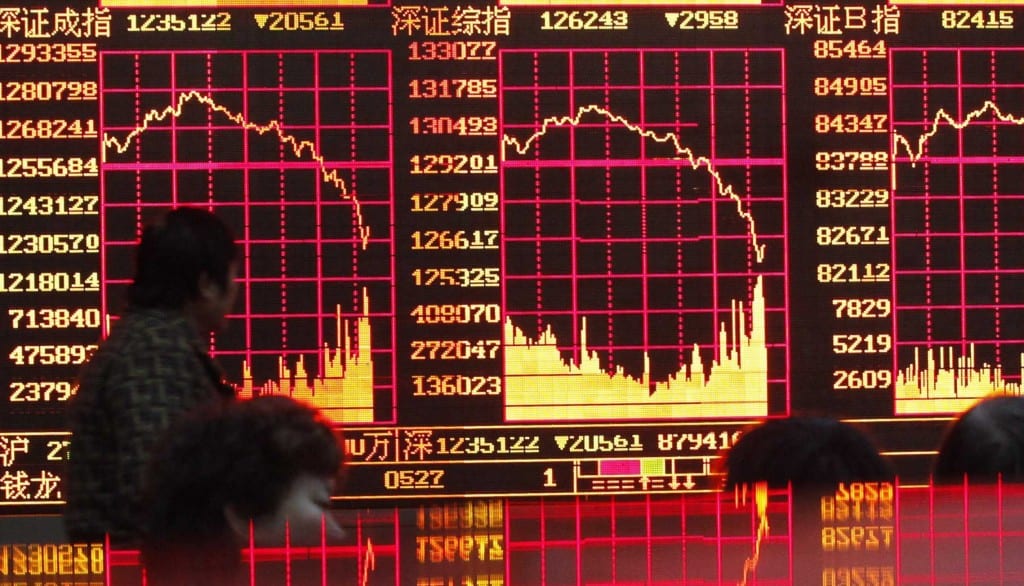

Trading in China’s stock markets has been halted for the rest of the day, after a 7 per cent plunge in the blue-chip CSI300 index in the afternoon trading session triggered a circuit breaker mechanism which came into effect on Monday (Jan 4).

Earlier in the session, trading in both the country’s equity indexes and equity index futures had been halted for a brief 15 minutes, following a 5 per cent decline in the benchmark index.

The rapid activation of the second trading halt just after 1.30 pm local time indicated “a rise in market volatility” following the first trade suspension.

“There was uncertainty in the markets. Investors were worried that maybe they might not be able to sell stocks after markets were halted,” Jackson Wong, associate director at Huarong international Securities, said in a telephone interview. “So when markets resumed trade, we saw an acceleration in selling.”

The fact that retail investors account for nearly 70 per cent of China’s stock-market trading volume also contributed to the rapid selloff.

“Retail investors are by nature more risk averse than institutional investors.. It isn’t hard to understand why markets legged down hard to the 7 per cent final breaker limit when markets reopened after the first circuit breaker was triggered and halted the market for 15 minutes, as this 15 minutes give a big window of opportunity for investors, mostly retail, to get new sell orders queued into the market,” Gavin Parry, managing director of Hong Kong-based Parry International Trading, said in an email interview.

For most of Monday’s session, Chinese shares were on the back foot, following a dismal reading from the latest Caixin manufacturing purchasing mangers’ index (PMI) and ahead of the imminent expiration of a share sales ban on listed companies’ major shareholders, according to IG’s market strategist Bernard Aw.

In addition, the move by authorities to cut the yuan’s value against the greenback on Monday, making it weaker than 6.5 for the first time in more than four-and-a-half years, added to the risk-off sentiment.

The Shanghai Composite ended down 6.9 per cent, while the smaller Shenzhen Composite nosedived 8.2 per cent. In Hong Kong, the benchmark Hang Seng index was pulled down nearly 3 per cent.

Mr Aw expects China’s stock markets to remain on a downward spiral on Tuesday. “I’m quite sure that there will be downward pressure tomorrow,” he said. “Circuit breakers only help to stall the pace of declines, but they do not stop the direction of movements.”

For CMB International’s Strategist Daniel So, China’s A-shares will likely see downward pressure in early trading on Tuesday, but may “turn north by (the) market close” on the back of support from some investors who believe that now is “a good opportunity for bottom fishing amidst panic selling”.

CIRCUIT BREAKER: BOON OR BANE?

The idea of a circuit breaker mechanism was first raised by the Shanghai Stock Exchange last September and officially confirmed on Dec 4, 2015.

Under the mechanism, a move of 5 per cent in either direction from the CSI300 index’s previous close will trigger a 15-minute trade suspension across the country’s stock indexes if the move occurs before 2.45 pm local time. After that, a 5 per cent move will prompt a trade suspension until the market closes at 3.00 pm.

Moves of 7 per cent in the index will spark a trading halt for the rest of the day.

The introduction of a circuit breaker seems to have sparked more unease among Chinese investors, despite its good intentions of limiting market volatility, according to Huarong’s Mr Wong.

“Investors are just getting used to the new mechanism. After they get used to the idea, it may not be as bad,” the Hong Kong-based analyst said. “But to be honest, 5 to 7 per cent swings is very normal for China’s markets so while the stock market circuit breaker is introduced with good intentions, it might not be a good idea given the experiences of Chinese investors.”

On the other hand, IG’s Mr Aw believes that investors should look beyond the short-term repercussions as the new mechanism will bring China’s markets more in line with international standards.

The circuit breaker system will also “complement” the current 10 per cent daily limit rule which is usually limited to only “a handful of stocks”, he noted.

Under current rules, individual stocks and index futures in China are allowed to rise or fall a daily maximum of 10 per cent from the previous closing level. Trading of a stock stops when it hits the daily maximum allowable limit.