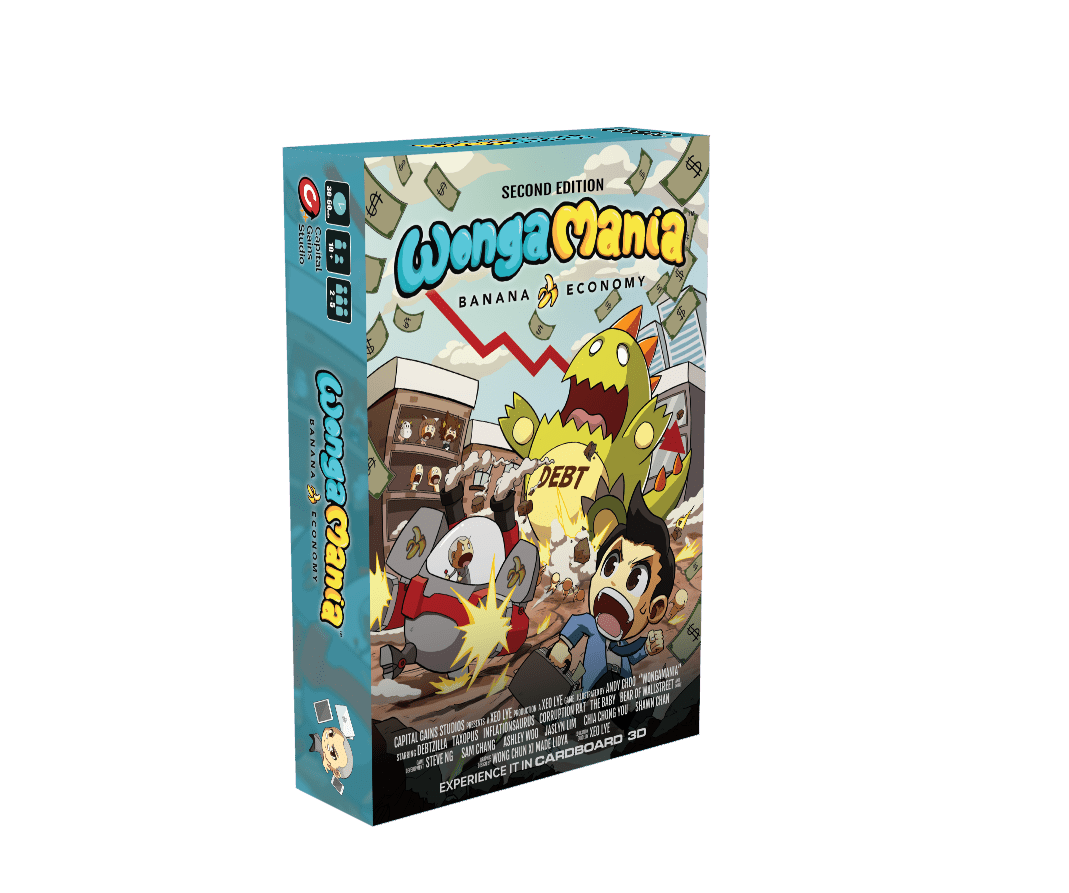

Capital Gains Studio is proud to announce the launch of the second edition of the best-selling financial boardgame – Wongamania: Banana Economy with more visually attractive graphic design, new mechanics, a new educational guide and a Chinese – English duo edition.

“Thanks to the popularity of our first edition, we decided to launch the 2nd edition with many upgrades,” said Wongamania Creator, Xeo Lye. “Other than an overhaul of the mechanics and graphic designs, we have included an educational guide to help players understand how the game ties in with real-life economics. As the financial literacy movement in Singapore becomes more vibrant, we hope that Wongamania can become an invaluable tool to make financial education fun and approachable.”

Economic Lessons from Wongamania: Banana Economy

While everyone loves money, most people hate learning about finance and economics. This irony is a result of all the thick tome of financial jargons, formulas and charts that many presumed that they have to master to be proficient in economics and investing. Capital Gains Studios is challenging and changing that status quo through their flagship board game, Wongamania: Banana Economy.

In the second edition of Wongamania: Banana Economy, the new educational guide would provide you a brief outline of economics by putting you in the role of an elite in a Banana Republic, controlling a corporation with the power to influence government policies on interest rates or tax policy, with the purpose of enriching your own investment interest. At the same time, you will play the role of market forces, defeating others at their own game by personal hardships and economic turbulence, therefore raising a necessary of purchasing insurance to cover yourself against insurable events and controlling your own fate/state of retirement.

A game will see you learning how to juggle different asset classes to maximize your income in good and bad times by depicting an economic cycle including 4 different segments: Recession. Recovery, Growth and Stagnancy. During each stage of the economic cycle, you have to allocate your assets most effectively, through diversification or focus investing.