Mobile operator Axiata Group Bhd, which reported a 34% jump in net profit to RM610.7mil in its second quarter ended June 30, is planning to restructure a US$590mil loan taken by its Indonesian unit into local currency-denominated partial sukuk.

The move, its chief financial officer Chari TVT said, would help the group manage its foreign exchange (forex) exposure, as the volatility in the currency market rises.

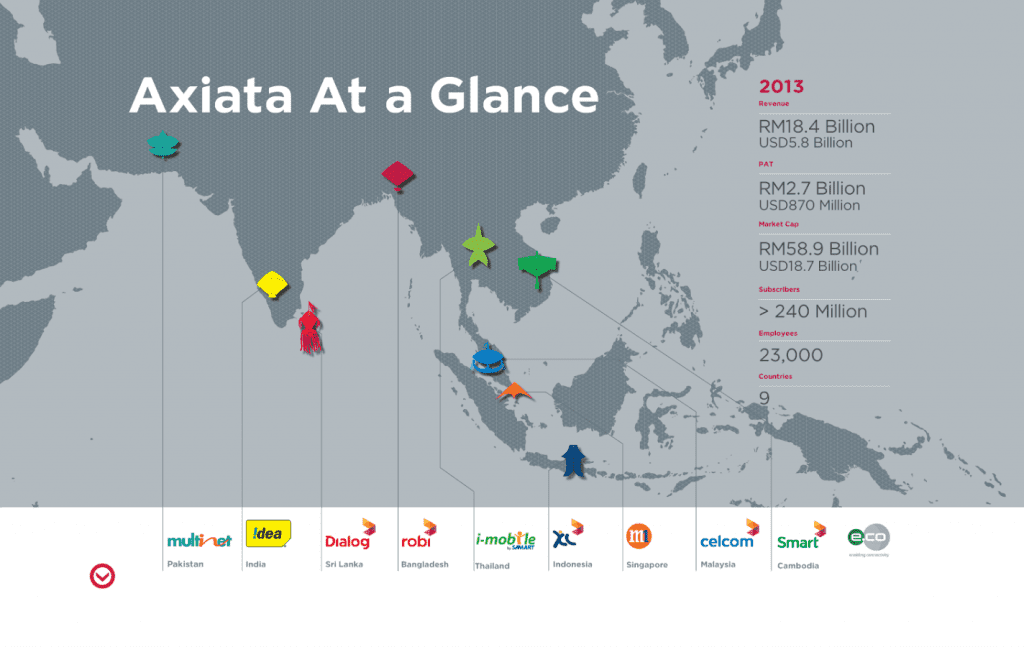

Apart from Indonesia, group borrowings include a US$134mil debt at its operation in Sri Lanka under Dialog Axiata PLC and US$100mil in Robi Axiata Ltd.

“We also have an exposure of US$590mil, which is unhedged, in PT XL Axiata Tbk, so the total amount of exposure is about US$823mil, inclusive of Dialog and Robi,” he told reporters at a press conference yesterday.

For operations in Malaysia, Chari said the group had borrowed some RM5bil, but there was no forex exposure as far as Malaysia was concerned.

He said this after the mobile operator’s net profit jumped 34.2% to RM610.7mil in the second quarter from RM455mil a year ago, mainly due to lower losses from Indonesia arising from lower forex losses and net finance costs.

Hong Leong Investment Bank Research said on a turnover of 11.1 trillion rupiah, XL had recorded a core net profit of 84 billion rupiah, accounting for 40% of the consensus estimate of 209.9 billion rupiah.

The research house noted that XL’s transformation strategy was fruitful and was beginning to show early promising signs and results. “This is evident from several positive leading indicators, including a materially improving subscriber mix, rising reloads per sub, joiner average-revenue-per-user significantly higher than churners’ and an increased share of modern distribution versus traditional,” it said in a note.

Chief executive officer Datuk Seri Jamaludin Ibrahim said XL’s transformation strategy was on track, as it saw a positive quarterly revenue from the group and plans to strengthen XL’s balance sheet to reduce its dollar exposure.

Higher profits were also recorded by the Sri Lankan and Cambodian operations, and the share of profits from its associate company in India increased significantly.

Revenue, however, was marginally lower at RM4.7bil compared with RM4.73bil previously due to lower revenues in Malaysia and Indonesia.

Chari said the group planned to keep its capital expenditure within the RM4.8bil level this year, but will be more cautious next year, as the ringgit is expected to remain volatile.

Meanwhile, Jamaludin said the group was reconsidering its listing plans for its Bangladeshi unit.

“It was true that we had wanted to list out Bangladeshi unit. But that was before they came out with a new rule saying that we did not have to.

“So, the current status is that we are re-evaluating whether we want the initial public offering or not. There are pros and cons,” he said.