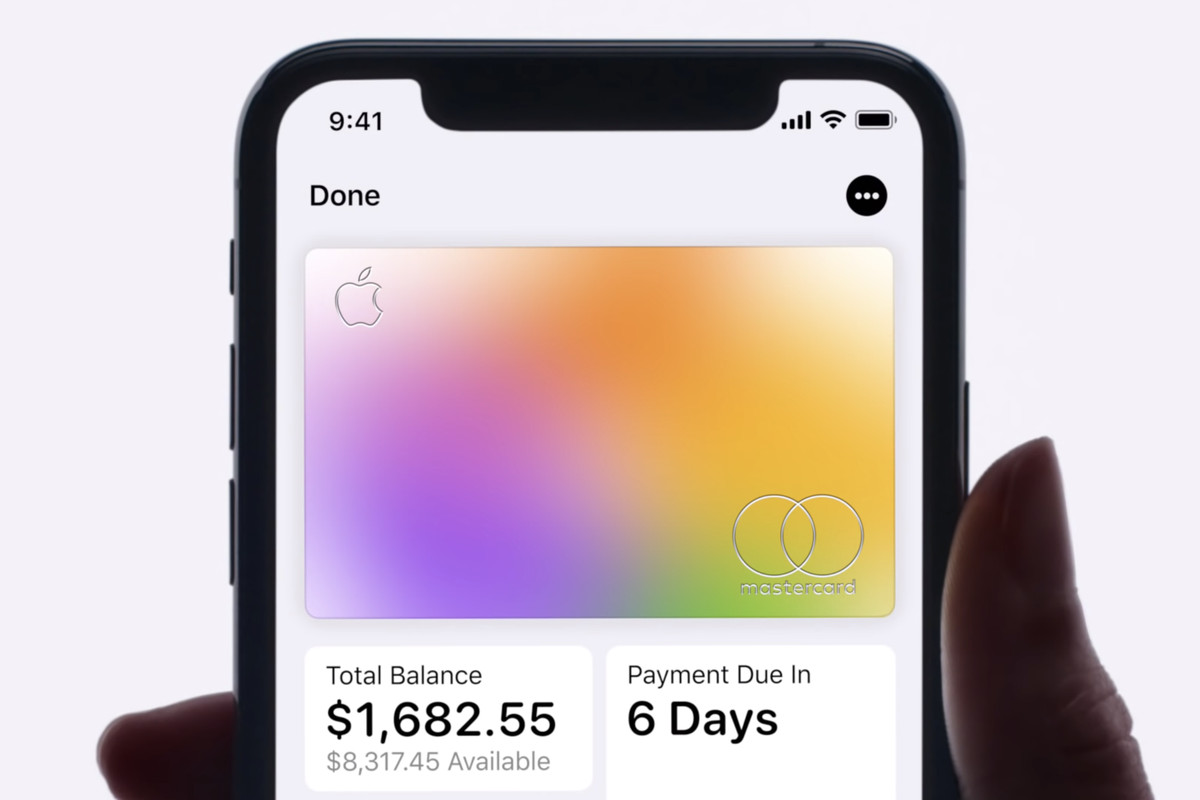

Back in March, Apple introduced the Apple Card. The virtual card sits in the iOS Wallet app, although an actual physical card can be ordered. For privacy reasons that card will not include the account number, but will have the user’s name on the card. Apple Card users will face no fees. That’s right, say goodbye to Late fees, Annual fees, International fees, and Over-limit fees. Card users will get back 2% of the value of transactions made outside of the Apple ecosystem and 3% of those purchases made from the App Store, Apple Store, and other Apple properties. Transactions paid for with the physical card will get 1% back. These rebates will be computed daily and made available each day.

The card is expected to launch sometime this month and investment banking firm Goldman Sachs is Apple’s partner for this project. Goldman Sachs has posted the Apple Card Customer Agreement and this reveals some interesting things. First of all, depending on the card user’s credit ratings, the annual interest on the card will range from 13.24% to 24.24%. Future changes will be based on any rate hike or cut made to the Prime Rate. This is the rate that banks charge their best customers for loans.

To be eligible for an Apple Card, you must have an Apple ID that is associated with a valid iCloud account. There must be an active email address connected to the Apple ID, with Apple’s two-factor authentication turned on. And those iPhone users who “jailbreak” their phone to remove iOS software restrictions are at risk of having the account closed. In addition, the Apple Card cannot be used to buy casino chips, lottery tickets, and cryptocurrencies. In other words, you can’t use the Apple Card to buy Bitcoins. This is probably not devastating news for the majority of consumers looking to open an Apple Card account.

“If you make unauthorized modifications to your Eligible Device, such as by disabling hardware or software controls (for example, through a process sometimes referred to as “jailbreaking”), your Eligible Device may no longer be eligible to access or manage your account. You acknowledge that use of a modified Eligible Device in connection with your Account is expressly prohibited, constitutes a violation of this Agreement, and could result in ours denying or limiting your access to or closing your Account as well as any other remedies available to us under this Agreement”-Apple Card user agreement.

So if you own a jailbroken iOS device, you’re not allowed to use it to apply for the card. And if you have an iPhone that you used to obtain a card, you cannot jailbreak it. Pretty simple rules. In fact, all of the terms and conditions of the Apple Card can be found on the Goldman Sachs website.

The Apple Card will be another business in Apple’s Services unit. After the iPhone, this segment is the second-largest in terms of revenue for the company, and it is the tech giant’s second most profitable division. Apple is aiming to hit $50 billion in annual revenue by next year for the Services group, double the $25 billion the unit grossed in 2016. For Apple’s fiscal third-quarter covering April through June, the company reported record Services revenue of $11.5 billion. The reason why this business is so important to Apple is that it is less dependent on iPhone shipments and is more dependent on the global active number of iPhones. At the beginning of this year, that number was approximately 900 million. Other businesses under the Services umbrella include the App Store, iCloud, Apple Music, Apple TV+, Apple News+, Apple Arcade (once it launches), AppleCare, Apple Pay and more.